NEWS & VIEWS

We noted on our website in early April that in an update to agents HMRC had quietly buried an announcement that the tax return for 2022-23 would contain new boxes for reporting gains on disposals of Excluded Indexed Securities. FSL promised to respond to this new regulatory requirement and provide our clients with new functionality to assist in their tax reporting. We are pleased to offer an update on our progress.

But first, a quick reminder of what HMRC has announced and why it matters:

The requirement

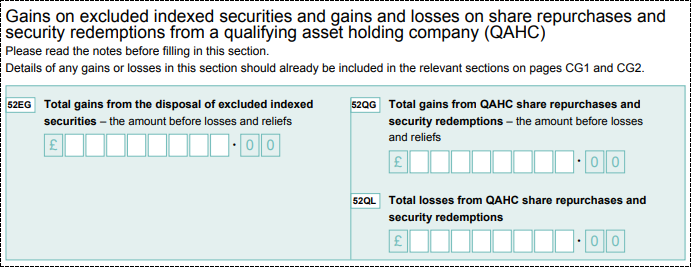

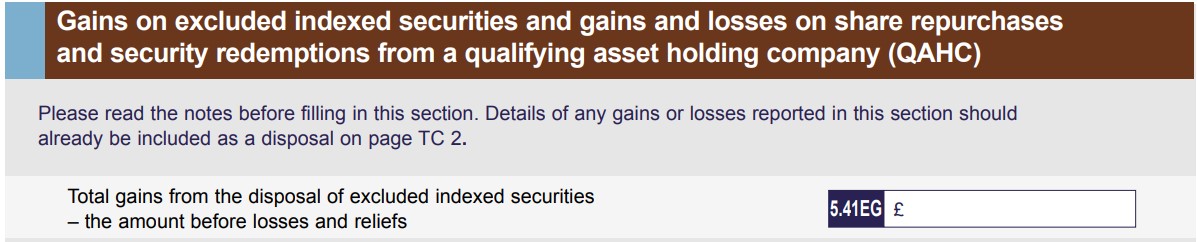

When individuals and trusts complete their tax returns for the 2022-23 tax year, due by 31 January 2024, they will see a new box on the Capital Gains form:

SA108 – Capital Gains section for individuals

SA905 – Capital Gains section for trusts

The important point to make up front is this: there is no additional tax revenue at stake. This is not about a new form of asset which must now be taxed. This is about an existing form of asset which had previously never needed to be set out separately to other assets.

Until now, gains on Excluded Indexed Securities were usually included in the figure for total gains on unlisted shares and securities. Indeed, they still will be: the new requirement, as stated in the tax return excerpts above, is to include the figure for gains on Excluded Indexed Securities in both the relevant Total boxes and the new boxes created just for these gains.

HMRC has not been particularly forthcoming on why the new boxes have been created or what they intend to do with the information. The update to agents only said that they were adding the boxes “so that gains arising on the disposal of excluded indexed securities can be reported.” As we have outlined, these gains were already reported elsewhere in the return, so this is not the true reason for creating the new boxes.

The development required

An Excluded Indexed Security yields a return on redemption for its investors which is based on the change in price of another asset. For instance, a note costing £10,000 which matures in one year, with two fixed interest payments during its life, which will redeem on a fixed maturity date, and which will pay out redemption proceeds of 105% of its current value if the price of gold on a particular market exceeds a particular threshold on a fixed valuation date. The conditions of the note would stipulate other redemption amounts if that threshold is not exceeded.

Until now Excluded Indexed Securities were included in the much broader category of Corporate Bonds. This has been industry standard practice for many years as Excluded Indexed Securities are a niche concern and did not need to be separated out for any reason beyond curiosity. With the new boxes on the tax return, there is now a requirement to report gains on disposals of these securities separately to gains on other assets.

FSL’s response

There were two clear development objectives for our flagship CGiX software:

- To provide the ability to classify securities as Excluded Indexed Securities

- To display the total gains on disposals of Excluded Indexed Securities as a distinct figure on applicable reports for entry on the end client’s tax return

After a lot of hard work, we are delighted to present the new functionality for Excluded Indexed Securities. This is now available in our most recent software version of 7.10.1.0 and you may now request an upgrade via your FSL contact at your earliest convenience.

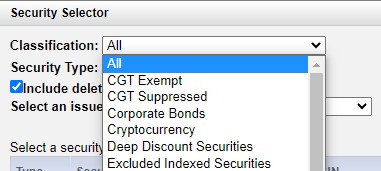

Classification

We have added Excluded Indexed Securities as a distinct asset classification. This is available when adding your own securities into CGiX and is a selectable option when filtering assets for classification. For those clients who receive our securities data under the Data Model 1 service, we continue to work hard reclassifying assets from the ‘Corporate Bonds’ classification to the new ‘Excluded Indexed Securities’ classification.

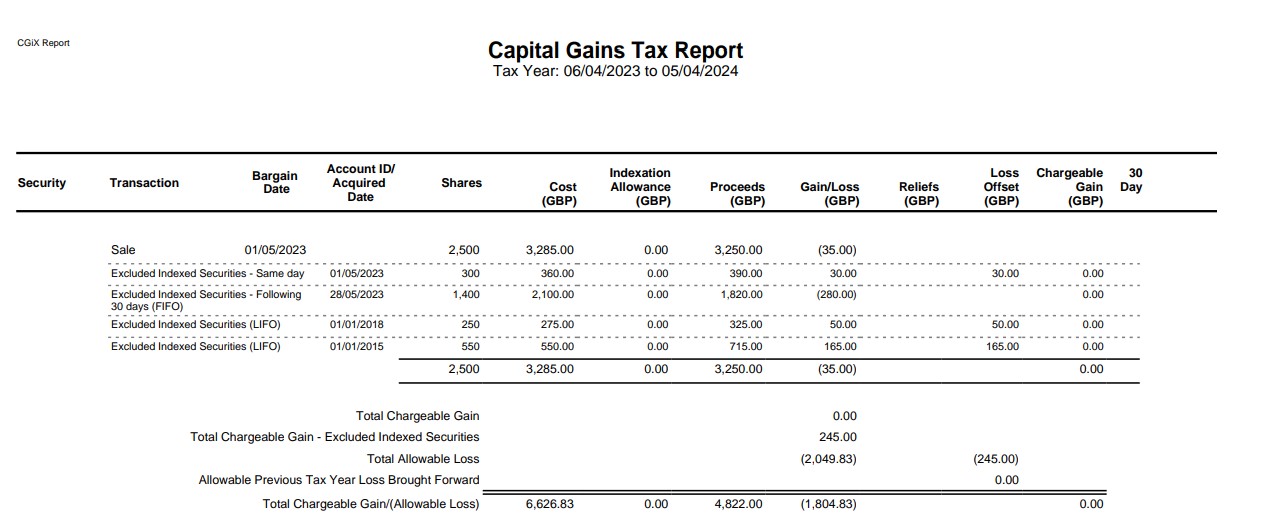

Capital Gains Tax report

This is an example of our CGT report for UK Individual clients. The same changes have been made to the CGT report for UK Trust clients.

There are several improvements to allow clients to comply with the new regulatory requirement:

- The asset is identified as an Excluded Indexed Security by the inclusion of the description ‘Excluded Indexed Securities’ embedded in the details of each disposal.

- The disposal on 1 May 2023 has been matched with acquisitions according to the relevant security matching rules

- There is a new total line called ‘Total Chargeable Gain – Excluded Indexed Securities’

- The figure given in the total line is solely the total for gains; it is the amount before losses or reliefs

- Losses on Excluded Indexed Securities are still included in the overall ‘Total Allowable Loss’

Any questions?

At FSL we pride ourselves on being responsive to developments, whether from client requests or regulations. Whilst the lateness of HMRC’s announcement precluded us from having this new functionality available in upgrades prior to the usual summer tax reporting season, we hope that by providing a new version of the software now, you can factor an upgrade into your plans for the next 9 months. If you have any questions about Excluded Indexed Securities or about CGiX then please get in touch with your FSL contact, or send us a message.