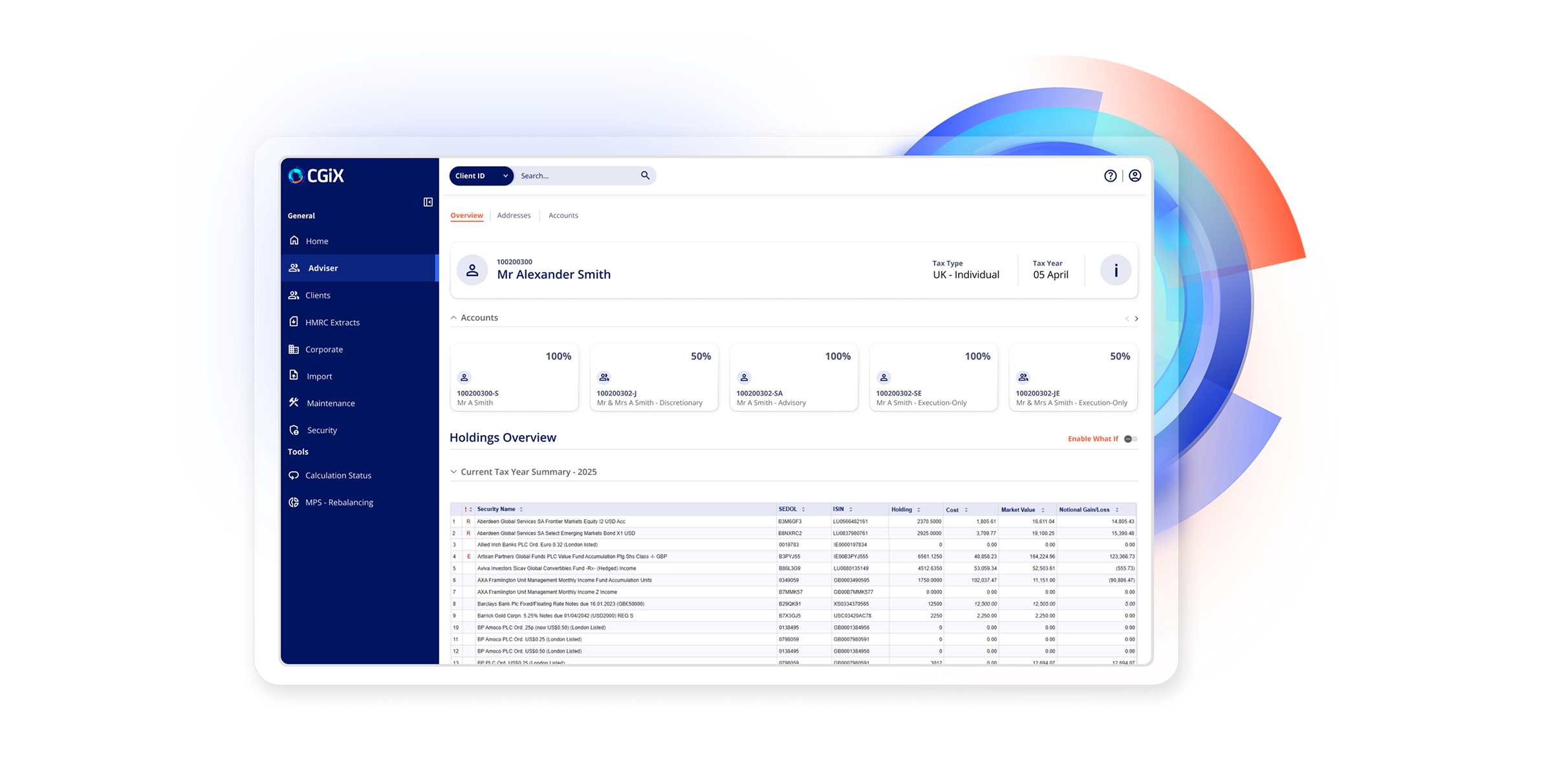

Simplifying the challenge of accurately reporting taxable wealth

The award-winning tax management solution, providing the industry’s

most accurate capital gains calculations since 1994.

Our market-leading software simplifies the process of tax management, analysis and reporting in the UK, US and Ireland.

When you choose CGiX, you benefit from over 30 years of financial expertise and the industry’s most in-depth corporate actions database. There isn’t a more comprehensive option for analysing tax-efficient outcomes for any type of investor.

- Tax reporting for individuals, multi-accounts, corporations and trusts, as well as charities and other non-reporting investors.

- HMRC-compliant tax packs, including income reporting, gains and losses calculations, Self Assessment tax returns and Excess Reportable Income (ERI).

- Regulatory reporting, including HMRC Other Interest returns and HMRC Bank & Building Society Interest returns.

- ERI data for capital gains tax and income reporting.

- Probate support, including income reporting, capital gains calculations and tax assistance for executors.

- Foreign income and gains reporting and assistance for individuals currently living in the UK with the rebasing of their assets under the new foreign income and gains regime.

- What If analysis tool, providing insights into potential future liability analysis, tax modelling, income forecasting and model portfolio rebalancing.

- Tax reporting for individuals, multi-accounts, corporations and trusts, as well as charities and other non-reporting investors.

- IRS-compliant tax packs, covering:

- Gains and losses calculations for 1099B.

- Income reporting for 1099INT and 1099 DIV forms.

- Tax reporting for individuals, multi-accounts, corporations and trusts, as well as charities and other non-reporting investors.

- Revenue Commissioners-compliant tax packs, covering:

- Gains and losses calculations.

- Investment undertaking tax.

- Self Assessment.

- Corporate Tax return (Form CT1).

- Form CG1.

- Form 1 Trust & Estate Return.

- Tax reporting for UK Life Funds, including sub-funds.

- A fully automated data import, calculation and reporting suite with a proven track record of handling large volumes of intraday trading activity at high speed.

- Capital gains tax report, catering for historic indexation uplift, where relevant, and loss offsetting.

- Automated pricing and NAV calculations for funds and sub-funds.

- Automated calculation of deemed disposals and deemed acquisitions at year-end for section 212 holdings.

- Realised and notional reports for section 212 holdings.

- Detailed transaction reports.

- In-built reconciliation function for fund holdings, trades, prices, and book costs.

- Exception logging for all funds and transactions.

- Multiple daily pricings available.

Our regularly updated database includes historical data dating back to 1965, meaning you have access to unparalleled coverage.

Our tailored service means you can get the best value possible out of your CGiX installation.

All our reporting is conducted in accordance with HMRC, IRS and Revenue Commissioners’ requirements, making tax reporting easier.

Over 30 years of market-leading financial expertise

Fully customisable and scalable solution

Personalised support and training

Language and formatting tailored to the unique needs of each jurisdiction

Continually updated database, covering all financial transactions and corporate action events

Nimble software that adjusts to evolving tax and financial legislation

HMRC, IRS and Revenue Commissioners-compliant data and tax reporting

Integrates with more than 30 proprietary and commercial office systems thanks to our API-first approach

Other services

FAQ

We can get you up and running on CGiX in as quickly as one month. Our go-live process is straightforward and fully supported, with our team of experts at hand every step of the way. Get in touch to discuss our different integration methods and discover what we could do for you.

CGiX is a fully customisable tax management solution. We will work with you to understand your firm’s unique requirements and preferences, so you get the best value out of your installation. Get in touch to discover how we could best serve your firm’s needs.

Our team of experts are at hand to answer any queries you might have via our personalised helpdesk service. We also offer one-to-one calls and training sessions, should you need more in-depth support.

Ready to streamline your tax management?

Get in touch to discover how we could support

your firm’s unique requirements.