Welcome to our latest CGiX Product Update. Here, you’ll learn about all the enhancements we’ve made to CGiX in our last six months of development and how these changes will make calculating your clients’ taxable wealth easier as we look to upcoming reporting deadlines and the new tax year.

This update provides you with a bitesize, straightforward overview of the changes we’ve made to CGiX, how different areas of your team will benefit as a result, and how things will evolve moving forward. We hope that by providing this biannual update, those reading can feel a greater part of our product development process here at FSL and help guide CGiX’s evolution as the industry’s leading solution for calculating and reporting tax on investments.![]()

![]()

A New Look for CGiX

Fresh Branding and Enhanced Usability

We’ve updated CGiX with a sleek, new interface to help streamline user workflows, improve ease of use, and enhance the overall visual appeal of our software. Our new look includes a refreshed colour scheme and an easy-to-use L-frame navigation bar, featuring a collapsible menu, updated user profile area and integrated access to our helpdesk service.

These subtle yet impactful changes provide you with a more intuitive user experience while preserving the essential and powerful functionality you’ll be familiar with on our platform.

“In today’s dynamic financial landscape, efficiency and ease of use are essential. With this in mind, CGiX has been enhanced with a streamlined user interface, helping users optimise their workflows while maintaining the best-in-class functionality we’re known for.” – Varsha Vora, Project Lead

These changes mark the first step toward our enhanced CGiX UI. We hope that they will smooth your transition as we take our platform to the next level later this year with the launch of a new screen built specifically with financial advisers in mind.

CGiX’s adviser screen – due for release in the second quarter of 2026 – provides an intuitive platform for front-office staff, supporting their strategic financial planning and empowering them to provide more comprehensive and tailored advice to investors.

Our recent UI development has been completed with careful attention to WCAG accessibility guidelines, reflecting our commitment to inclusive design and accessible user experiences.

New MPS Rebalancing Tool

Deliver Proactive, Tax-Efficient Advice with CGiX’s Model Portfolio Rebalancing Tool

The popularity of model portfolio services (MPS) has grown rapidly in recent years. According to research by Morningstar, the size of the UK on-platform MPS market was estimated to be £139 billion at the end of 2023 – around 14% of the total UK wealth management market.

But recent reductions in the annual exemption amount for capital gains tax has made rebalancing model portfolios even more challenging for financial advisers.

With CGiX’s new MPS Rebalancing Tool, financial advisers can quickly and easily assess the capital gains tax impact of potential model rebalances, without the need to execute a single trade.

Our MPS Rebalancing Tool gives you a clear, detailed view of each investor’s year-to-date CGT positions, factoring in realised gains, current-year losses and any carry-forward losses. This helps you set realistic goals for your clients and guide financial conversations with ease.

The tool also allows you to drill down into gains and losses by security and by client, so you can provide more accurate, tailored advice and present your clients with a comprehensive picture of which trades will have the largest tax impact.

Whether you need to respond to changing tax rules, market volatility or evolving client needs, our MPS Rebalancing Tool allows you to adapt plans quickly and assess a wide range of strategies so you can deliver proactive, personalised and tax-efficient advice.

New RESTful API

Faster Turnaround Times for Clients with Our New RESTful API

Several components of our CGiX Web API have now been migrated to our new RESTful ‘Phoenix’ API. This marks an important step in our phased, long-term transition toward a more scalable, efficient platform that preserves the core functionality of our Web API while offering a more flexible experience, automated workflows and easier integration with external partners. Case Study: One of our clients recently upgraded to our SaaS platform and completed a major system upgrade. The results were impressive.

Case Study: One of our clients recently upgraded to our SaaS platform and completed a major system upgrade. The results were impressive.

They saw their daily file conversion and loading times cut in half. The move also meant that they could now finish a 2,500-tax pack run in just 1.5 hours. Before switching, this would have taken a full working day.

“We’re proud to introduce the new RESTful Phoenix API, a major milestone in our transition from our legacy CGiX Web API. This upgrade is all about delivering smoother integrations and more efficient operations for our clients. While the migration is still underway, we’re confident it will unlock long-term benefits and new opportunities for clients that work with CGiX.” – Mina Patel, Project Lead

Our team has also been hard at work optimising CGiX, including improvements to its underlying database, to deliver a faster, more responsive experience. Thanks to work done to enhance log retention controls and remove redundant or duplicate records, multi-company clients will now enjoy faster processing speeds, improved system performance and smoother day-to-day operations.

US Tax Reporting Suite

A Comprehensive US Tax Reporting Suite for Individual Investors

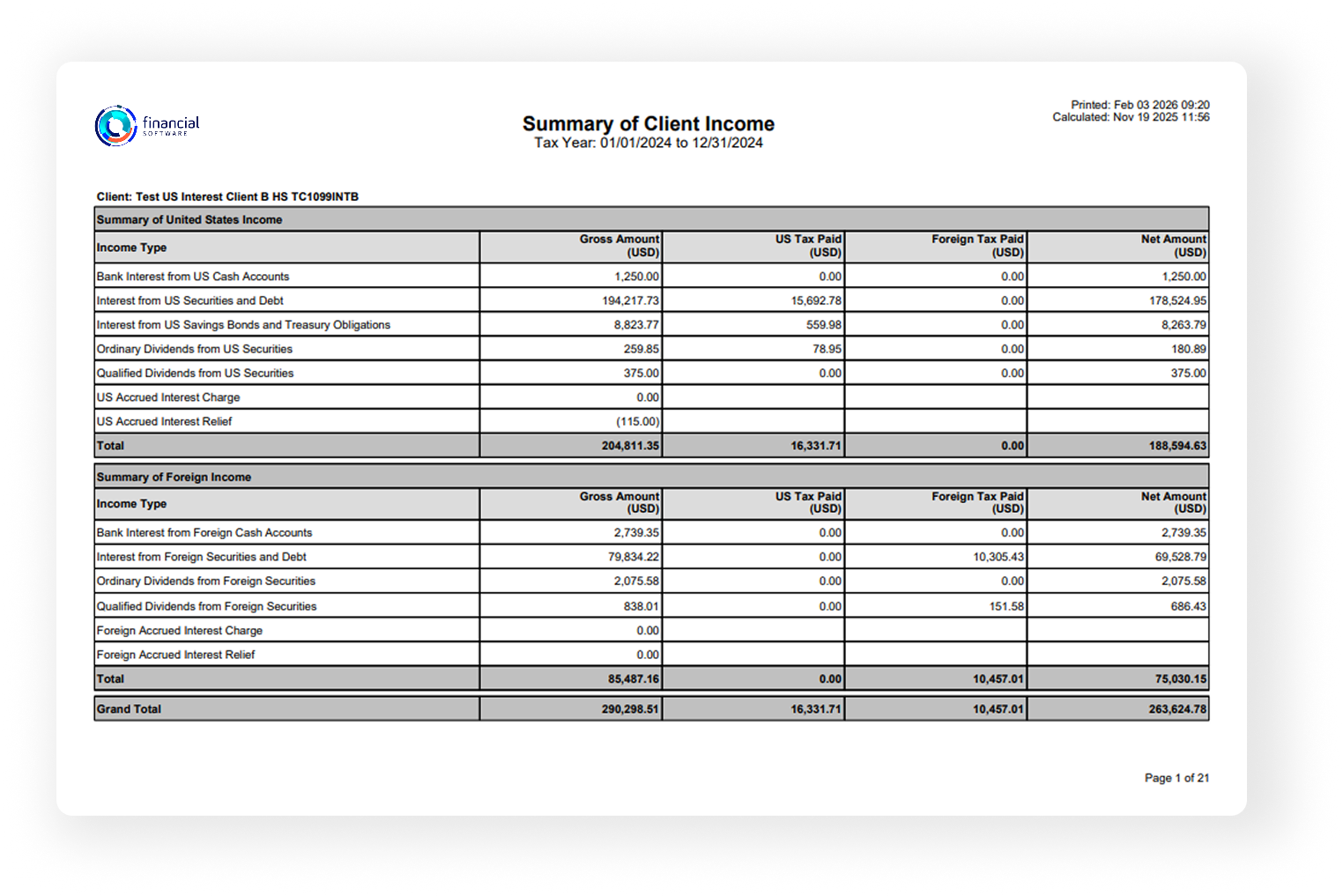

The team has been hard at work developing a set of reports that your tax team can use to complete the IRS 1099-B, -DIV and -INT forms.

Just as with CGiX UK, our new reports are designed to contain all the data fields you need to complete your clients’ regulatory reports with ease. The new reports have a consistent look and layout to what you are used to seeing with our UK reports, but use the appropriate US terminology, fields and date formats.

It is important to note that we at FSL do not have Qualified Intermediary status, and we currently do not have plans to gain it. As a result, our reports are only to be used to populate the relevant IRS forms.

“When we began looking at developing our US Reporting Suite further, we knew we had to make sure the reports themselves and the data that you can output from CGiX was compliant with regulation in the US. We also wanted to make sure that our reports were easy to follow for the end-client, just as with our UK Tax Reporting Suite, and I think we’ve done a stellar job.” – Alex Ranahan, Project Lead

What’s Coming Next?

Our team has just kicked off their next twelve weeks of product development. This time round they’ll be focusing on the further expansion of our US tax reporting suite, additional screens for our new CGiX user interface, and establishing more ways we can help our clients streamline their integrations and improve their processing speeds.

But that’s just a snippet of what’s to come in the next six months.

We have plans to take our platform to the next level this summer with the introduction of a new screen built specifically with financial advisers in mind. We’ll also be amping up work on a secret project we’ve been working on in collaboration with one of our clients – we can’t wait to share more details soon.

That being said, our plans are never set in stone. At FSL, we are dedicated to taking an agile approach to our product development. This means our priorities can and do change to meet evolving client needs or a shifting legislative backdrop. So, if there’s anything you’d like to see prioritised in our next sprint, something you like to see added to work we’ve already done or thoughts about what we should build next, please get in touch. CGiX is built for our users so their wants and needs are paramount to how we work.